Bankrupt?

There's a bit of mystery behind change

Trying a new angle to the whole Substack publication. The idea going forward will be to talk about things I’m passionate about, related to startups, entrepreneurs and freelancers. It will be all about resources, ideas and opinions.

Over the past weeks I’ve been increasingly running (on purpose) into more and more founders, entrepreneurs and freelancers. While my focus is very deliberate in those conversations, I count’t help but notice that we all face similar roadblocks regardless of what we are doing. It could be from networking, to getting traction, clients, or simply looking for a good way to automate things in order to do more.

So, over the next couple of months I’ll be changing this publication to cover a wider range of topics related to how to build stuff. Any stuff, from a startup, to a shop, a tattoo studio, a graphic design firm or lemonade stand.

The principles for all will remain the same.

So you thought that only small startup or SMEs suffer from bad financial performance, or those “bad things” only happen only when you are starting out, haven’t reached product market fit or reached billions in revenue? Well, “poor” financial performance is everyone’s problem, especially if you don’t pay attention.

There are rumors and speculation about ChatGPT going bankrupt by the end of 2024, and that’s kind of obvious. They are, after all, creating a new market and pioneering in very expensive novel models. Plus, it's a machine that's highly costly to operate.

Running advanced Ai systems isn’t cheap, with daily costs reaching hundreds of thousands of dollars. This year alone, they might spend about $7 billion on Ai training and another handful of billions on staffing. Their revenue, which is projected to reach $4 billion a year, just isn’t enough to cover these expenses.

OpenAi has raised billions of dollars in funding to keep things going and is valued at about $80 billion. But as investors start to worry about the long-term profitability of Ai ventures, getting more funding could be tough. Without a steady stream of money, OpenAi’s ambitious projects and day-to-day operations are at serious risk, even with some help from Microsoft’s discounted Azure services.

But how do they know this? tracking at any stage, your project finances is key. It might be so obvious but not many actually do so. Most startups and SMEs neglect all aspects of finance till it’s too late. And in cases where you are not as lucky as OpenAi, to have such novel and well back business, the chances of success are slim to none. As you will not see it coming.

In conclusion, if you are a startup founder, and you are not Sam Altman, have a good eye to your finances, metrics, runway and burn. And if you are looking for a tool, that’s free, you are in luck, as we are building one at EvryThink

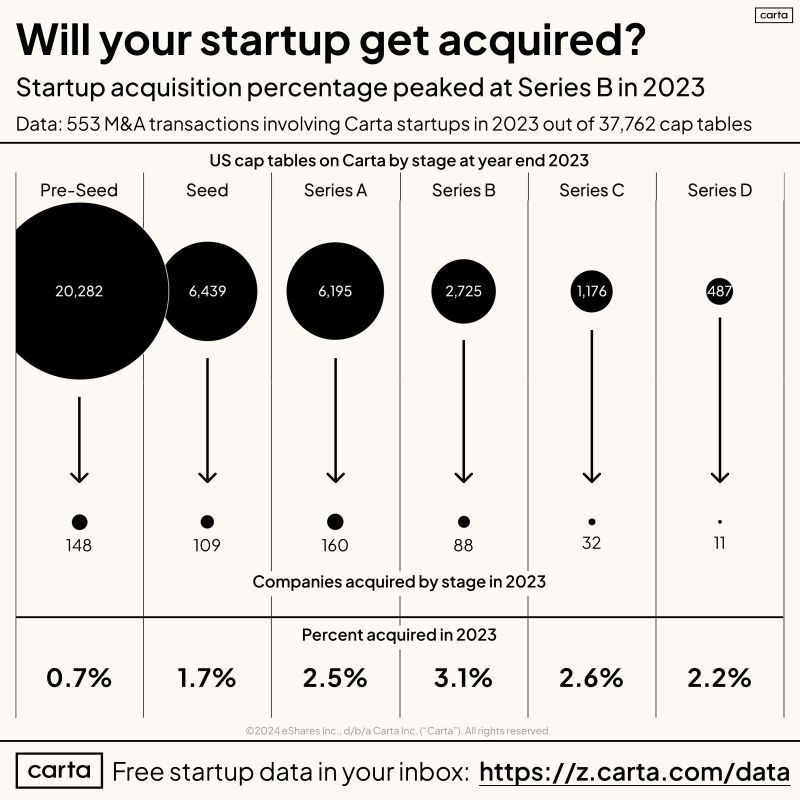

Starting a business is a wild ride, and not many actually dare to do so. It requires a particular drive, a particular will to not only complain about what's not working but to sit down and build change. One of the big dreams for some startup founders is to get acquired by a larger company. But how realistic is this dream? Let’s dive into some recent stats that shed light on this.

First off, let’s address the elephant in the room: the odds of getting acquired are slim, especially in the early stages.

According to data from Carta, only 0.7% of 21K pre-seed startups get acquired (just in the US)). That's less than 1 in 100. Things improve a bit at the seed stage, with an acquisition rate of 1.7%. These early stages are tough because startups are still proving their ideas and finding their footing.

It’s a high-risk phase with a lot of uncertainty.

The “good news” is that the odds get better as you move through the funding stages. For Series A startups, the acquisition rate jumps to 2.5%. This means that once you’ve shown some traction and potential for growth, bigger companies start paying attention. The best stage for acquisitions, however, is Series B, where the acquisition rate peaks at 3.1%. By this stage, startups have generally proven their market fit and scalability, making them attractive targets.

After Series B, the rates dip a bit but still remain significant. Series C and Series D startups have acquisition rates of 2.6% and 2.2%, respectively. These companies are more established and might be gearing up for bigger moves like an IPO.

So, if you can overcome the fact that about 90% of startups fail, aiming to get your company to at least Series B could be your best bet for an acquisition.

But, the most important aspect to have in mind is that, taking a good care of your company thought the time matters, especially when it comes to finance, product and growth.

Over the pats month I’ve been actively looking around to find new and practical ways to identify good sources of information. From investors, to other startup founders, free resources and communities we can join. Over the next publications, I will be sharing these resources on my LinkedIn.

Some of those resources were paid, some were free. But a few things I’ve learned is that if you look hard enough, if you’ll find all you need with little or no cost. There are other things that can help out, there are a few people out there

Here are 10000 contacts investor lists/databases:

2000 funds of VCs in the US > https://geni.us/2000usVC

1000 funds of funds in the US > https://geni.us/1000vcUS

1000 funds of funds in Europe > https://geni.us/1000vcEU

Best European VC funds > https://geni.us/bestEUVC

350 Most Active Angel Investors in the US > https://geni.us/350USangel

200 Ai Angel Investors > https://geni.us/100AIinvestors

250 US Ai Angel Investors > https://geni.us/200aiUS

100 best VC funds in SaaS > https://geni.us/100vcSaas

100 best VC funds in the UK > https://geni.us/100vcUK

900 Climate VCs > https://geni.us/900climateVC